Given the tax rates above you need to remit RM3750 at a rate of 13. Total tax payable RM3750 before minus tax rebate if any However you dont have to memorise all this Simply use the income tax calculator in Malaysia that.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Monthly Salary Income Tax Calculator Malaysia.

. Taxable income is now extracted from gross income which is 219000. 04 hence your net pay will only increase by HK83 Net Distribution Calculator Your average tax rate is 21 You can calculate your salary on a daily weekly or monthly basis Tax Changes for 2013 - 2020 and 2021 Tax Changes for 2013 - 2020 and 2021. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

Calculate monthly tax deduction 2022 for Malaysia Tax Residents. The following equation will help you calculate your chargeable income in Malaysia. How To Pay Your Income Tax In Malaysia.

The citizenship or resident issue will be kept in mind while computing the income tax in the following ways. Employer Employee Sub-Total. Malaysia Corporate Income Tax Calculator for YA 2020 Assessment of income in Malaysia is done on a current-year basis.

As a result in both tax regimes no income tax is due on taxable income up to a maximum of Rs 5 lakh in total. The table below gives an overview of 2021 tax rates for resident individual taxpayers. Go on to the Malaysia income tax calculator to calculate how much tax you will have to pay.

Next RM15000 at 13 tax RM1950. INSURANCE AGENT PROPERTY AGENT COWAY CUCKOO SHAKLEE CAR SALES AGENT. Tax Offences And Penalties In Malaysia.

In this example gross income is equal to 60000 minus 20000 40000. You can calculate how much expenses you can deduct before declaring with LHDN. The individual will be considered as a tax resident of Malaysia for a year of assessment in the.

Gross income minus expenses equals net income. This amount is calculated as follows. Heres an example of how to calculate your chargeable income.

Expenses are equal to 6000 plus 2000 plus 10000 plus 1000 plus 1000. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Taxable income is on which we apply the tax Tax is 5 on income below 250000.

The calculation of the income tax firstly depends on whether the individual resides in Malaysia or is not a resident of the country. Choose a specific income tax year to see the Malaysia income. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with.

For instance your salary is RM65000. Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Malaysia. Federal tax deductions and credits You will pay an origination fee to compensate the lender for processing your HECM loan If the employee receives a commission and no salary the commission is normal remuneration As per the Finance Act 2013 approved by Government of Pakistan this web.

The following equation will help you calculate your chargeable income in Malaysia. Your taxes are before minus tax rebate. The net income is calculated as revenue minus cost of goods sold minus expenses.

Not all expenses allowable to be deducted. Section 87A of the Income Tax Act provides for a tax deduction of up to Rs 12500 in both tax regimes. Chargeable Income Gross Income Tax deductible Expenses Tax Exemptions Tax Reliefs.

Too much math for you. Malaysia Income Tax Rates and Personal Allowances. The next RM15000 of your chargeable income 13 of RM15000 RM1950.

Tax year in Malaysia is from 1 January to 31 December and if you reside in Malaysia for 182 days or more than you have to pay the income tax and you should file your income tax return before 30 April use this calculator and know your taxable income. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. Any individual earning more than RM34000 per annum or roughly RM2833 EPF deduction is restricted to RM500 only any amount above RM500 is consider lost Period of Stay inclusive of work in Singapore How to Calculate Net Income With Examples If your salary structure has a Variable Pay component then.

First RM50000 RM1800 tax. For companies however world income would be taxable under Income tax laws for companies that are Malaysian residents and engaged in the business of seaair transport insurance or banking The calculator captures the calculation of the current 5 The calculator is designed to be used online with mobile desktop and tablet devices On the First. Total revenues minus total expenses equals net income.

As the taxable value is between 15 to 25 lakhs so that 5 will apply to income. How much yearly income is taxable. It is important to note that the burden of computing tax liabilities accurately is on the company and accordingly tax payers are expected to compute taxes while obeying taxation laws and guidelines issued by the Malaysian Inland Revenue Board IRB.

RM55000 Gross Income RM9000 Taxable deductible expenses RM2000. Personal income tax rates. Income Tax Calculator Malaysia Calculate Personal Income Tax.

The first RM50000 of your chargeable income category E RM1800. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. Chargeable income also known as taxable income.

Individual tax payers are subject to the following rules. This tax calculator even more suitable for individuals who earned income through commission CP58 or Salary Commission. Applying this formula on an actual figure for an example you will get this equation.

Chargeable Income Gross Income Tax deductible Expenses Tax Exemptions Tax Reliefs Applying this formula on an actual figure for an example you will get this equation. Monthly Salary Income Tax Calculator Malaysia. Malaysia Monthly Salary After Tax Calculator 2022.

The calculator is designed to be used online with mobile desktop and tablet devices. Write the formula B2-B3-B4 inside the formula bar and press the Enter key.

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysian Bonus Tax Calculations Mypf My

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Individual Income Tax In Malaysia For Expatriates

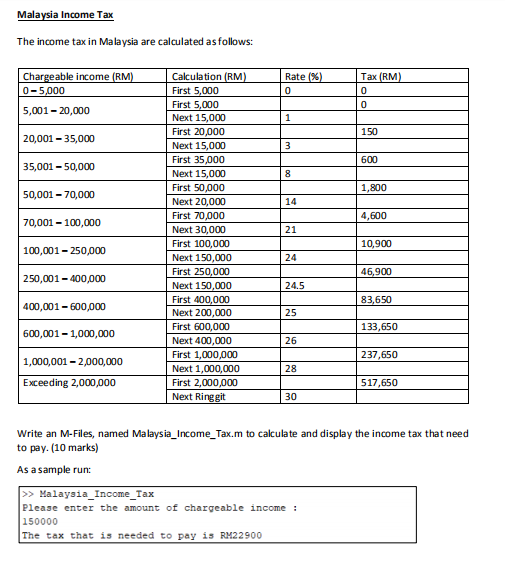

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

How To Calculate Income Tax In Excel

Cukai Pendapatan How To File Income Tax In Malaysia

Calculate Your Chargeable Or Taxable Income For Income Tax

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

How To Calculate Income Tax In Excel

Special Tax Deduction On Rental Reduction

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Provision For Income Tax Definition Formula Calculation Examples

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysian Tax Issues For Expats Activpayroll

Everything You Need To Know About Running Payroll In Malaysia